-

AUTO

Ontario Auto Insurance

Navigating Auto Insurance in Ontario: A Must for Every Motorist

Auto insurance in Ontario isn’t just a legal mandate — it’s your safeguard on the road. Our province requires all drivers to have minimum standard coverage, ensuring that everyone is protected against potential damages and injuries.

Your Trusted Ontario Auto Insurance Partner

Choosing the right auto insurance provider in Ontario is crucial. At The 1057 Group, we specialize in crafting tailor-made auto insurance solutions. Our experts are well-versed in the nuances of Ontario’s auto insurance requirements and are committed to securing the best coverage at competitive prices for you.

Mandatory Coverages:

Third-Party Liability:

Statutory Accident Benefits:

Uninsured Automobile Protection:

Direct Compensation-Property Damage (DCPD):

Tailor Your Policy with Optional Coverages

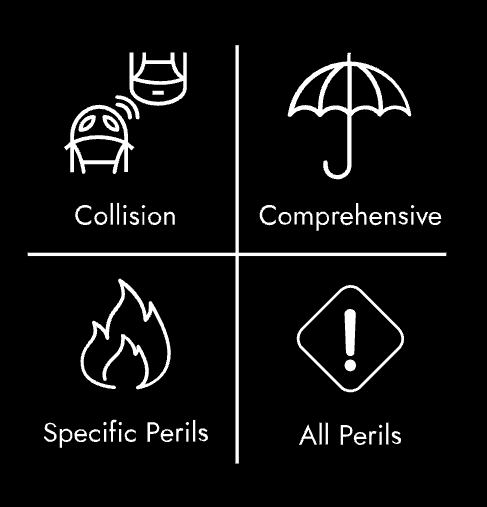

Collision: Covers damages from collisions.

Comprehensive: Protects against theft, vandalism, and environmental damages.

Specified Perils: Focuses on specific risks like fire or theft.

All Perils: A combination of Collision and Comprehensive for all-encompassing protection.

FAQ

Frequently Asked Questions: Understanding Auto Insurance in Ontario

In Ontario, your personal details significantly influence your auto insurance rates. Factors that insurers consider include:

Age and Driving Experience: Younger drivers and those with less experience typically face higher rates due to increased risk.

Driving Record: A history of accidents, traffic violations, or claims can increase your premiums.

Type of Vehicle: Insurance costs can vary depending on your car’s make, model, year, and safety features. High theft vehicles can be more costly to insure or may require higher deductibles to be applied or anti-theft devices to be installed.

Location: Living in areas with higher traffic density or higher rates of theft and collision claims can lead to higher premiums.

Usage of the Vehicle: The more you drive, the higher the risk of an accident. Your commute length and annual mileage can affect your rates. Insurance History: Gaps in insurance coverage or a history of missed payments can negatively impact your rates. Each insurer uses a unique formula to assess risk, so rates can vary.

Yes, you can certainly personalize your auto insurance plan in Ontario. While certain coverages are mandatory, such as third-party liability and statutory accident benefits, there are several ways you can tailor your policy to fit your specific needs:

Optional Coverages: You can add optional coverages like collision, comprehensive, or all perils to enhance your protection.

Deductibles: Choosing higher deductibles can lower your premium, but it means you’ll pay more out-of pocket in the event of a claim.

Policy Limits: You can opt for higher coverage limits for added financial protection, though this may increase your premium.

Special Endorsements: Add-ons like rental car coverage, roadside assistance, or coverage for custom parts can be included based on your requirements. It’s important to discuss your individual needs with us to ensure you have the right balance of coverage and affordability. Connect with Our Ontario Auto Insurance Experts.

In Ontario, auto insurance typically follows the vehicle, not the driver. This means if someone else is driving your car and is involved in an accident, it’s your auto insurance policy that will be called upon to cover the damages, subject to the terms and conditions of your policy. Here’s what you need to know:

Coverage and Liability: If the person driving your car has your permission (is an authorized driver) and is involved in an accident, your auto insurance coverage will apply. This includes any standard and optional coverages that you have on your vehicle.

Impact on Insurance Premiums: Since your insurance policy is used in the event of a claim, this could potentially affect your future insurance premiums, especially if the driver is found to be at fault.

Exclusions and Limits: Be aware that certain exclusions might apply. For example, if the person driving your car is uninsured or explicitly excluded from your policy, your insurance might not cover the accident. Additionally, if the driver’s use of your vehicle doesn’t align with the provisions of your policy (e.g., using it for commercial purposes while you’re only covered for personal use), the claim might be denied.

Deductibles Apply: In the event of a claim, you will be responsible for paying the deductible associated with your policy, even though you were not driving.

Permission is Key: It’s important that the person driving your car has your explicit permission. If your car is taken without your consent and involved in an accident, you should report it to the police and your insurer immediately.

Inform Your Insurer: If someone will be regularly using your car, it’s a good practice to inform your insurance company and possibly add them to your policy to avoid any complications in the event of a claim. It’s always recommended to check with your insurance provider to understand the specific terms and conditions of your policy regarding other drivers. Policies can vary, and it’s

In Ontario, it’s generally required to add your children to your auto insurance policy if they are licensed and will be driving your vehicle. Here’s what you need to know:

Mandatory Disclosure: If your children have a driver’s license and they will be driving your vehicle, you must inform your insurance provider. Failure to do so could lead to complications or denial of coverage if they are involved in an accident.

Insurance Premiums: Adding a young or new driver to your policy will likely increase your premiums. This is because young and inexperienced drivers are considered higher risk due to their higher likelihood of being involved in accidents.

Occasional vs. Principal Operators: If your child will be driving your car occasionally, they still need to be added to your policy. However, the impact on your premium might be different compared to adding them as a Principal operator.

Driving Record Matters: Your child’s driving record, once they start building one, will impact your insurance rates. Encouraging safe driving habits is important to keep insurance costs manageable.

Discounts and Savings: Look for potential discounts for young drivers, such as good student discounts for maintaining high grades, or discounts for completing a certified driver’s training course.

Policy Review and Adjustments: It’s a good idea to review your coverage options when adding a young driver to your policy. You might need to adjust your coverage limits or consider additional protections. Independent

Policies for Teen Drivers: In some cases, it might be beneficial or necessary for your child to have their own policy, especially if they own their own vehicle. Always discuss with your insurance provider to understand the best approach for adding your children to your policy. They can provide personalized advice based on your specific situation, coverage needs, and potential cost implications.